Why Apple won’t make the iPhone I want

Have you wondered why iPhones have continuously grown over the last several years? Me too. I did some research into why (margin), what drives it (price laddering), and what a compelling small form factor phone could look like (a new mini).

By: Kevin Horn

October 22, 2025

When developing new products, especially in maturing or established categories, companies are often focused on the expansion of TAM (Total Addressable Market) through the addition of new models, new features, and increasing value for consumers. Apple’s iPhone is one of the most visible and successful examples of this, with a 17 year history of rapid, yearly iteration, an expanding product portfolio, and command of the market for new smartphones, especially in the United States.

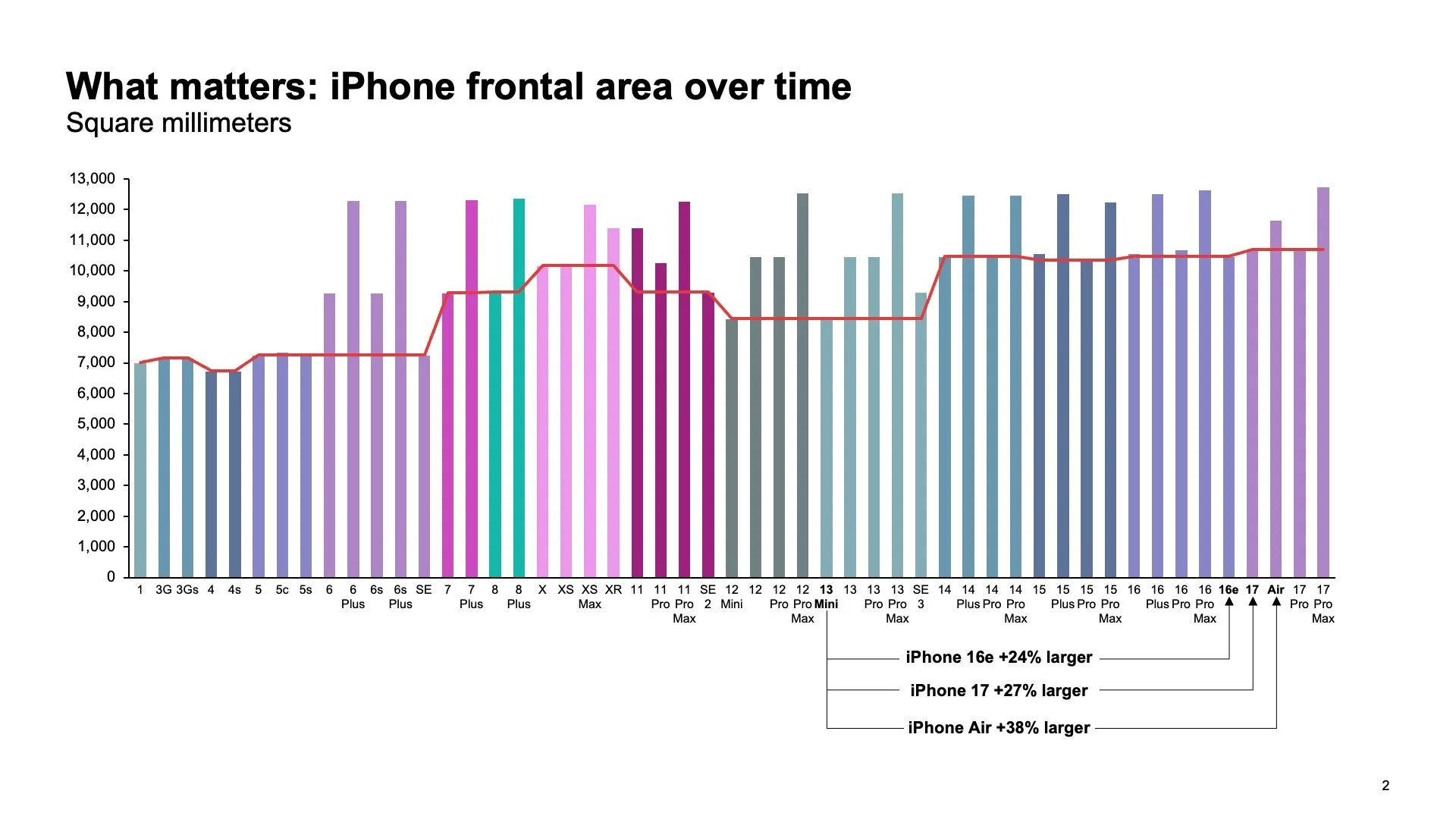

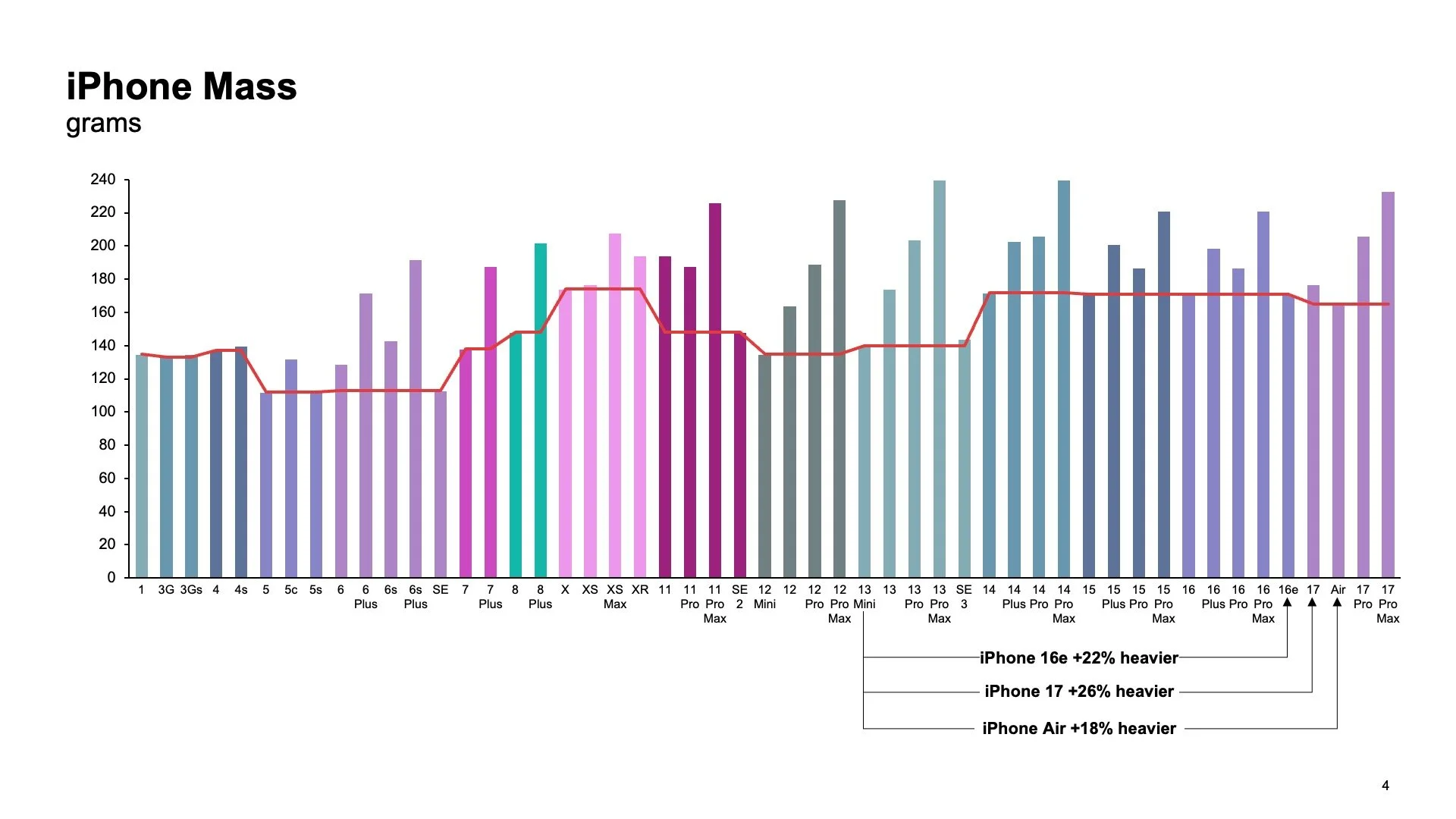

As the product category has matured over 10 years, Apple has steadily released larger iPhones. Today, the smallest iPhone is 26% heavier with a front face that is 34% larger by area than the smallest model from 4 years ago. I wondered what was driving this from a product management perspective and decided to use some open analysis to answer these questions and draw some conclusions that may apply more broadly to product development.

The iPhone Air

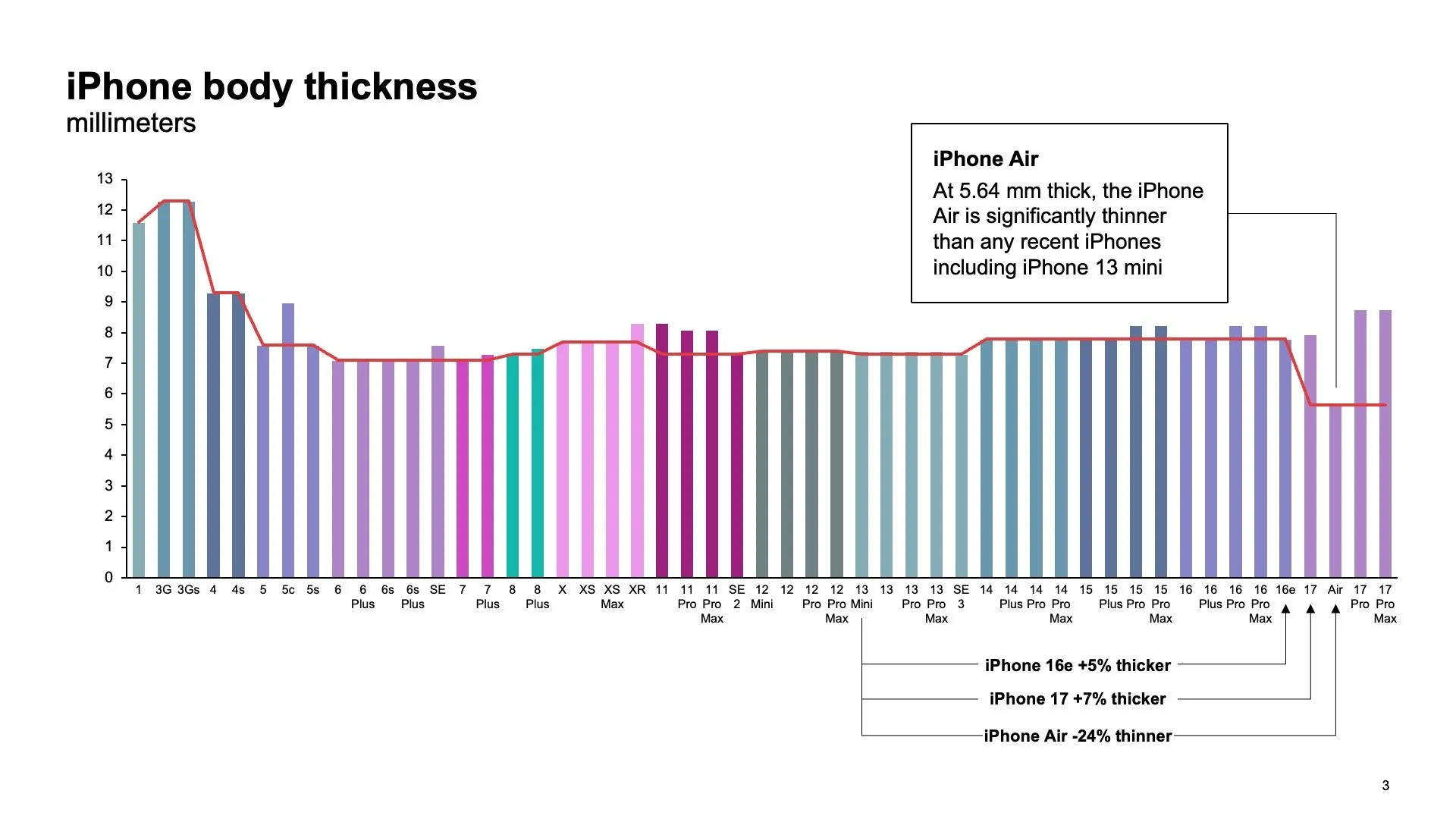

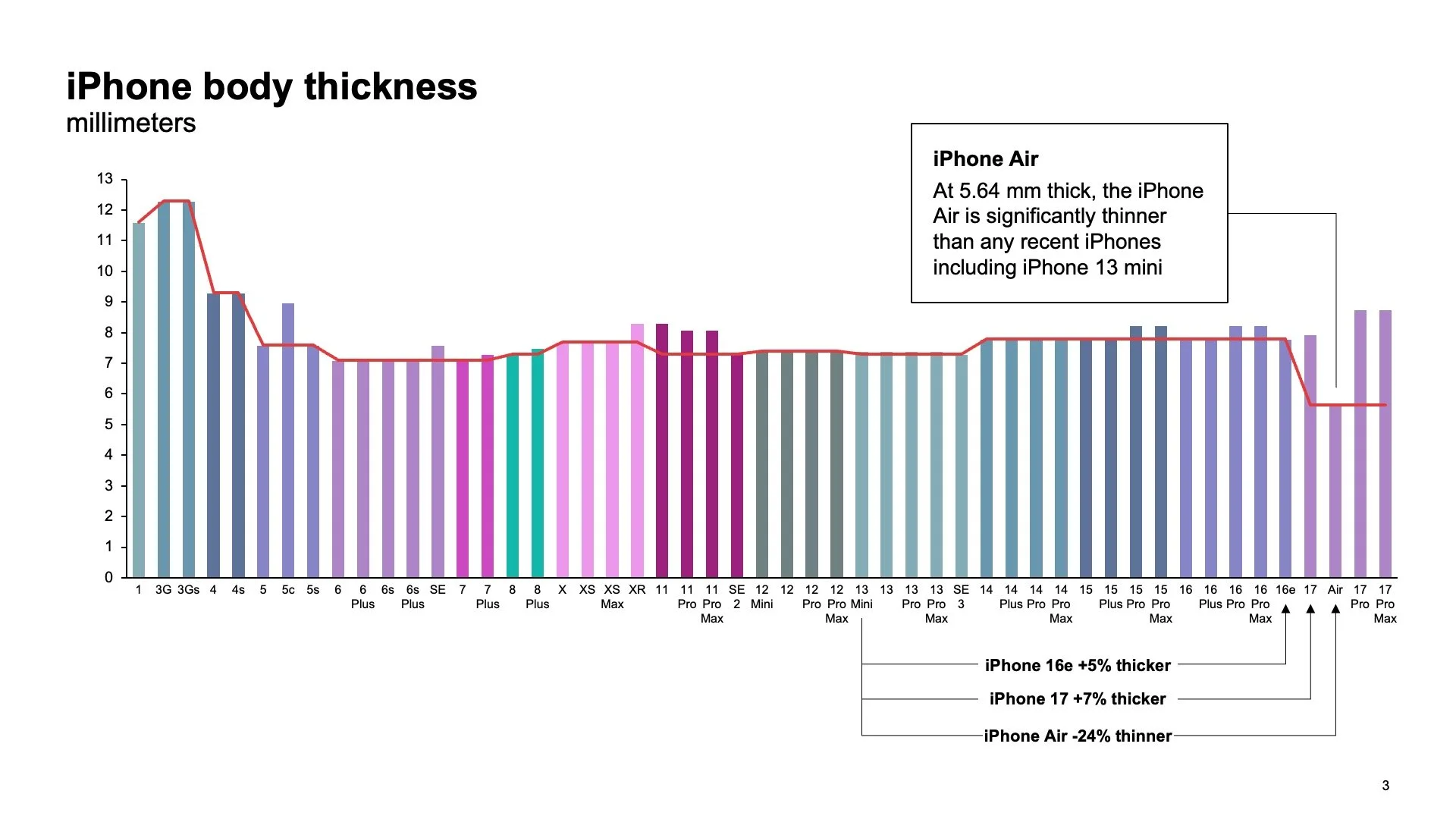

Apple recently released the iPhone Air as part of the iPhone 17 family of devices. As claimed by Apple, the Air is the thinnest ever iPhone, measured at the body at 5.64 mm thick when excluding the camera island. Priced at $999, the Air is $200 more than the $799 iPhone 17 line, and $100 less than the $1099 iPhone 17 Pro, fitting in the middle of the line reflecting its larger screen size than the base iPhone 17.

The iPhone Air: “The thinnest iPhone ever” (apple.com screen capture)

2025 iPhone 17 lineup (apple.com screen capture composite)

While it may be thin, the iPhone Air has a larger screen than the base iPhone 17 and slots between the iPhone 17 and iPhone 17 Pro Max in overall size. A comparison of frontal areas for all iPhone (overall length x width) shows that Apple has left behind small-bodied phones in the recent history of the iPhone lineup. Phones have only increased in size since the 2021 iPhone 13 mini.

iPhone frontal area (overall length x width) has grown significantly over time. Line indicates the smallest size in a given generation of releases and doesn’t reflect out of year sales (e.g., last year’s phone at discounted rate)

To make the Air worthy of the name, they debuted a very thin design, with the main body of the phone measuring 5.64 mm thick. To achieve this, Apple made significant tradeoffs, largely a single camera and reduced battery life and capacity relative to its iPhone 17 peers.

iPhone body thickness over time. The iPhone Air is an outlier in recent trends of thicker phones after the iPhone 13 generation. Note this does not include the camera bump, island, plateau, or lenses, as reflected in Apple’s marketing and specification materials.

Discussion around the device has largely been around how and why Apple made this tradeoff of thinness for performance and battery life.

Climbing the ladder to larger phones

Apple maintains a clear pricing strategy for iPhones: more screen for more money, more Performance or Pro for more money, and older models are less money. Starting back in 2014, Apple released the first “plus-sized” phone in the iPhone 6 Plus, itself a larger version of the iPhone 6, which would have otherwise been the largest iPhone ever. They accomplished three things:

1. Responded to competitive pressures of large format Android devices

2. Justified an increase in the selling price the iPhone year over year

3. Created clear price-laddering for customers to walk up to higher priced models

After the iPhone 6 Plus, Apple has maintained and improved on the Plus model, now embodied in Pro Max position in the lineup. They also, sporadically produced small format iPhones, culminating with the iPhone 13 lineup.

The iPhone 13 lineup had the largest choice in physical form factors of any recent iPhone generation (apple.e.com scree capture)

While well received, the iPhone 13 mini ended up being the last of its form factor, and that has created lasting questions among consumers and enthusiasts as to why.

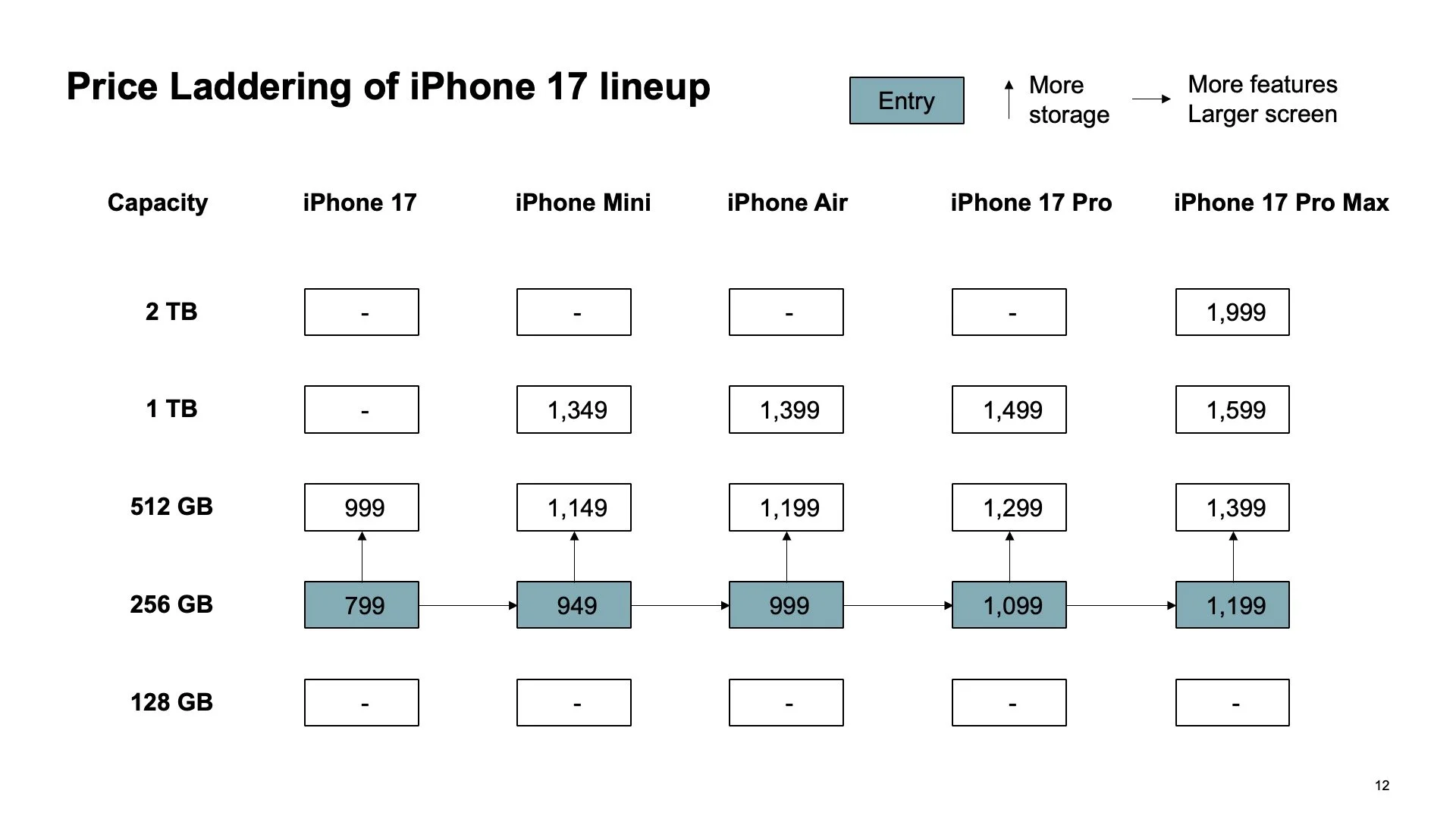

As Apple has matured and grown the iPhone lineup, it has introduced a system of Price Laddering that provides opportunities for consumers to move up to a higher priced product at each price point.

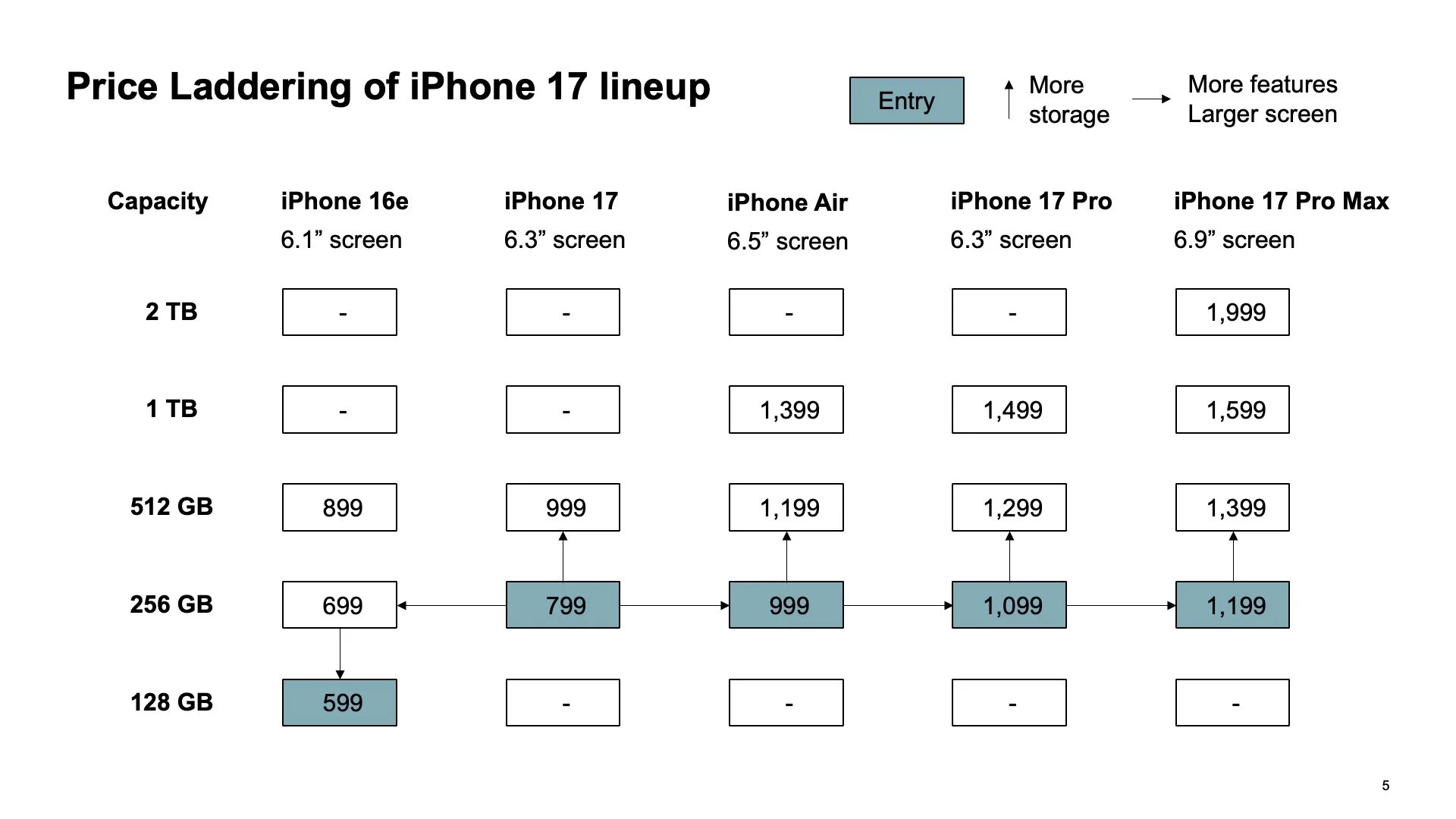

The Price Laddering scheme of the iPhone 17 lineup. For every device, there is a clear option to increase capacity or move up to a more expensive and higher end or larger device.

At each entry point of the iPhone 17 lineup (shaded), Apple offers an upgrade for additional storage on the same model of iPhone, or an upgrade to a higher tier of iPhone with better features like improved cameras, faster application processor, and longer battery life. You generally cannot get more storage or better features, at the same price point, without trading down on the other.

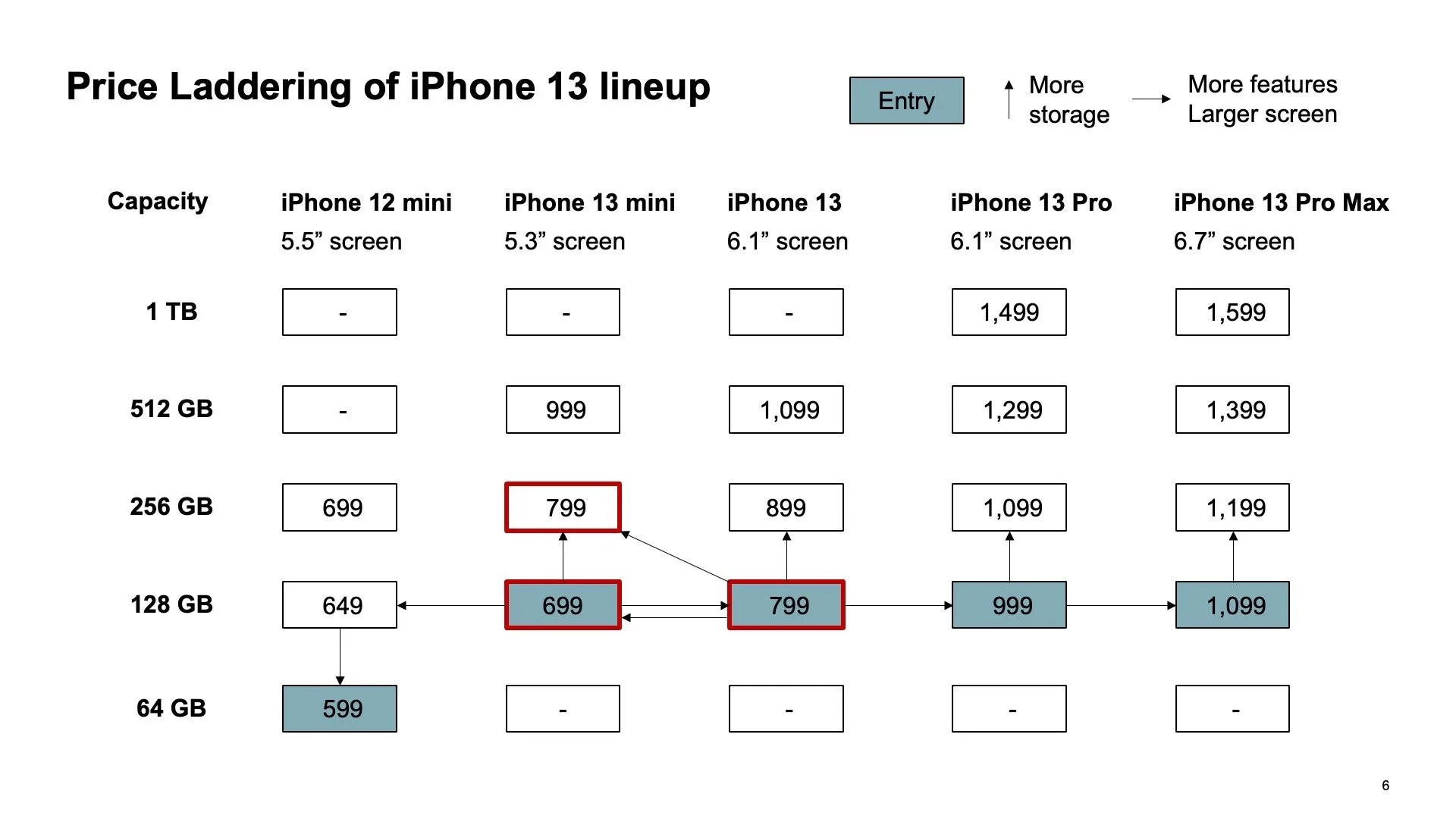

Price laddering is not new, but 2021’s iPhone 13 lineup provides ample examples of where this could have un-intended consequences. Apple used a familiar price laddering strategy with $100 increments between models. The decision to price the iPhone 13 mini at $699, $100 less than the iPhone 13, created tension in the pricing scheme.

At launch, it was widely celebrated that the iPhone 13 mini had nearly identical feature set and performance to the full-sized iPhone 13, with minor concessions on battery life due to the smaller form factor. This created tension in the pricing model. With the lower starting cost of the iPhone 13 mini, you could now choose between the “newest iPhone” in the smaller size at a lower price, or upgrade that phone to a higher capacity storage at price parity with the full sized iPhone.

In addition, the prior year’s iPhone 12 and 12 mini were reduced by $100 creating additional confusion such that the consumer now had a choice: full-size, year-old model or mini-sized, current model, all at lower cost than the “default” iPhone 13. This both created too many options in the Price Ladder at the $599 to $799 price range and contributed to further margin dilution on the iPhone mini line.

In the iPhone 13 lineup, the existence of the meant that stepping up to a higher cost and margin device was not the clear choice with the existence of the iPhone 13 mini.

Tracking margin of lower cost options

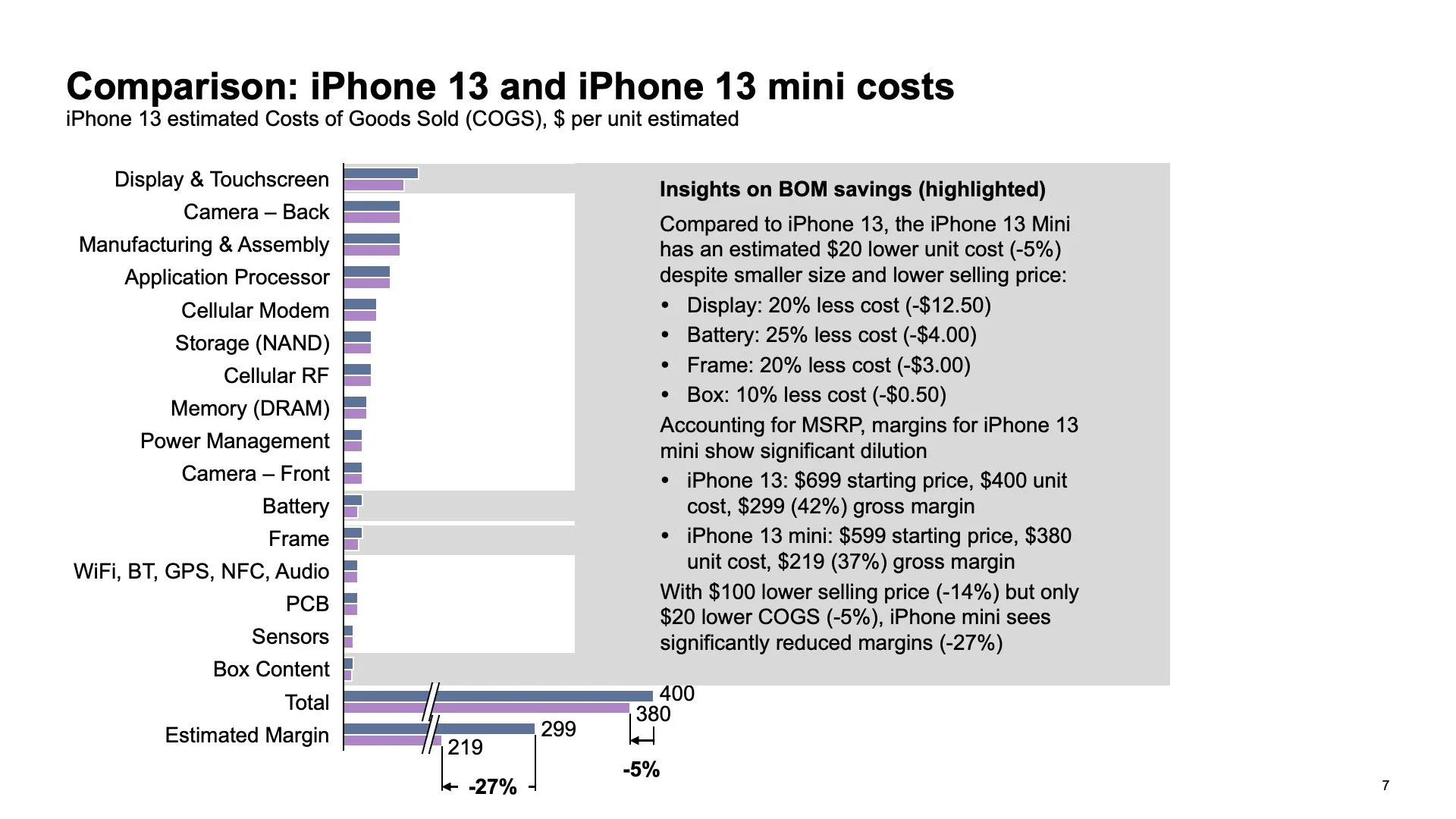

When looking at the costs and profit margins associated with the design and production of an iPhone, Apple has high levels of consistency in product design across models of a given generation. For the iPhone 13 era, there was significant overlap across models from the smallest 13 mini to the largest 13 Pro Max. These devices shared display technology, application processors, with the base 13 and 13 mini having one deactivated GPU core on the same die as the 13 Pro, NAND storage, RAM, battery technology and other primary cost drivers.

When Apple physically shrank the iPhone 13 and chose to maintain technical equivalency and feature sets, most of the cost drivers of the phone did not reduce cost in line with a physical shrink. This meant that despite the reduced price, the cost to manufacture the phone was similar, and therefore the iPhone 13 mini had less margin than an equivalently configured iPhone 13. Based on some open research and previously published information, I estimate that the unit cost of an iPhone mini is only about $20 less than a full-size iPhone, despite a $100 lower selling price. Only a few components, display, battery, frame, and packaging, were able to see price reductions owing to physically smaller sizes, while most of the cost drivers were assumed to remain constant as they were shared components and not impacted by the size reduction.

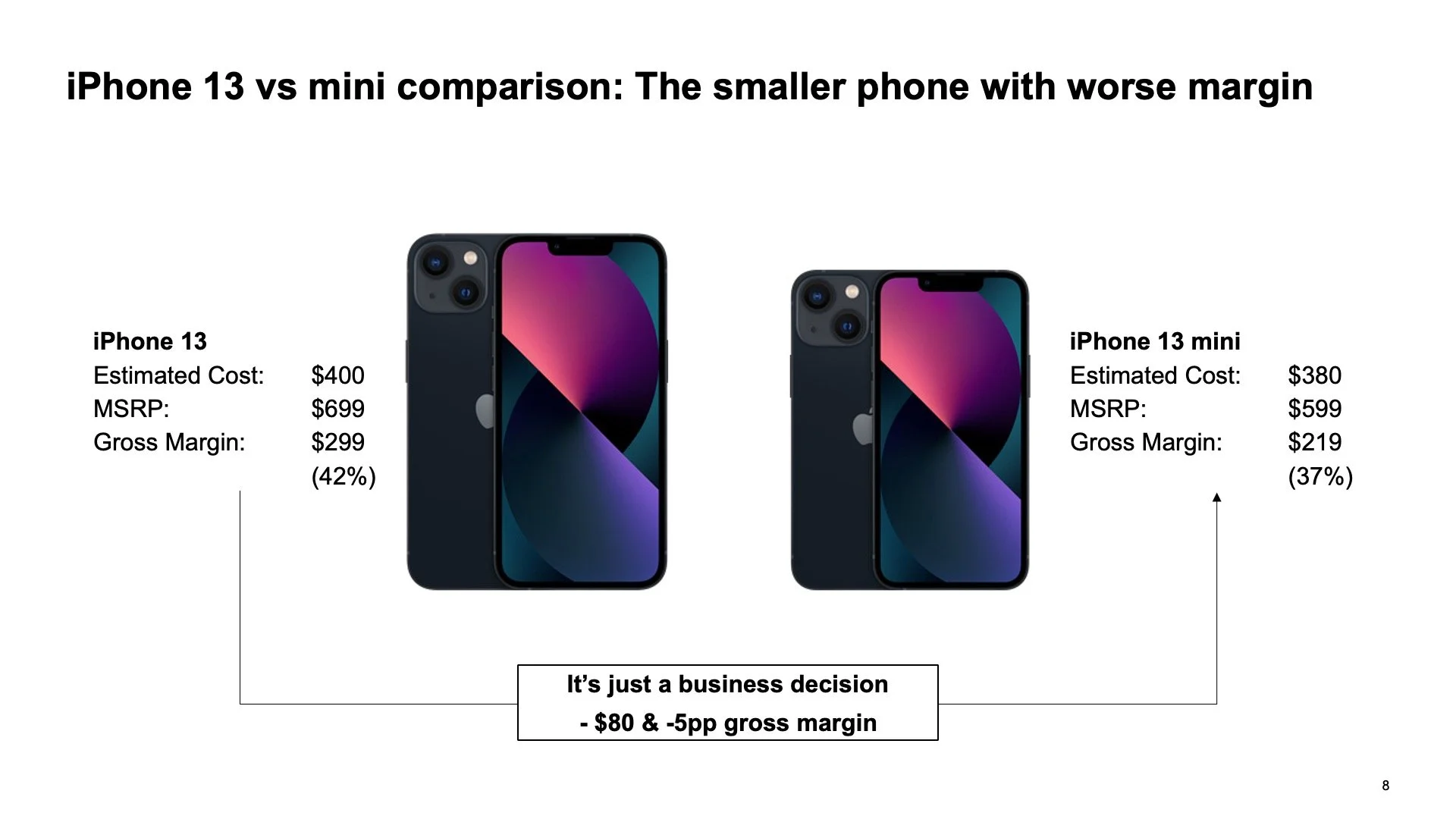

The decision to price $100 lower, despite not having equivalent BOM savings, ensured that gross margins were significantly smaller for an iPhone mini.

The costs of making a smaller device are largely insensitive to physical size. Only 4 categories are thought to vary with size: display, battery, frame, and box. Note that all costs are high level estimates based on public data.

The lower price point combined with similar costs of the iPhone 13 mini meant that margin would have been significantly worse. Note that all costs are high level estimates based on public data.

The iPhone 13 mini was ultimately discontinued with the release of the iPhone 15. The decreased margin inherent of the shared design, combined with the lower price on the price ladder, ensured that this device was a worse performer from the perspective of the company. Apple likely chose to discontinue the lower margin device to focus on better (financially) performing devices higher on the price ladder, with correspondingly larger physical designs and prices. It probably wasn’t just a problem of poor sales (rumored to be at less than 10% of overall sales), rather it was the larger problem that selling more hurt the overall margins of their largest and most important product line.

Could Apple build a compelling iPhone Air mini?

We’ve established that a smaller screen commands a lower price point in Apple’s rather rigid price laddering scheme. And thinness has always been marketed as a premium or luxury feature. You only need to return to a few classic product unveilings, with Steve Jobs pulling the MacBook Air out of a manilla envelope to dramatic effect to understand the positioning of thinness as luxury in the lineup.

While Apple has succeeded in creating demand for larger and higher priced devices, the devices are objectively getting larger while their role as primary computing devices grows. The size of the average human hand has not changed, making these devices simply larger for most people. There has been a consistent and vocal minority of users who lament over the loss of the smaller form factor, as well as growing market demand for “dumb phones” with small form factors.

Steve Jobs’ legendary unveiling of MacBook Air from a manilla envelope. Thinness was the primary specification that mattered for the MacBook Air. (YouTube screen grab)

Apple’s response to this demand for a smaller phone appears to be the thinnest-ever iPhone Air. With Apple optimizing for thinness over overall size and compactness, it doesn’t address the concerns of those who are concerned with growing screen sizes of the phone. Therefore, we will use the iPhone Air as the basis of a parametric exercise to estimate what the size, performance, and market position of an iPhone Air mini would be.

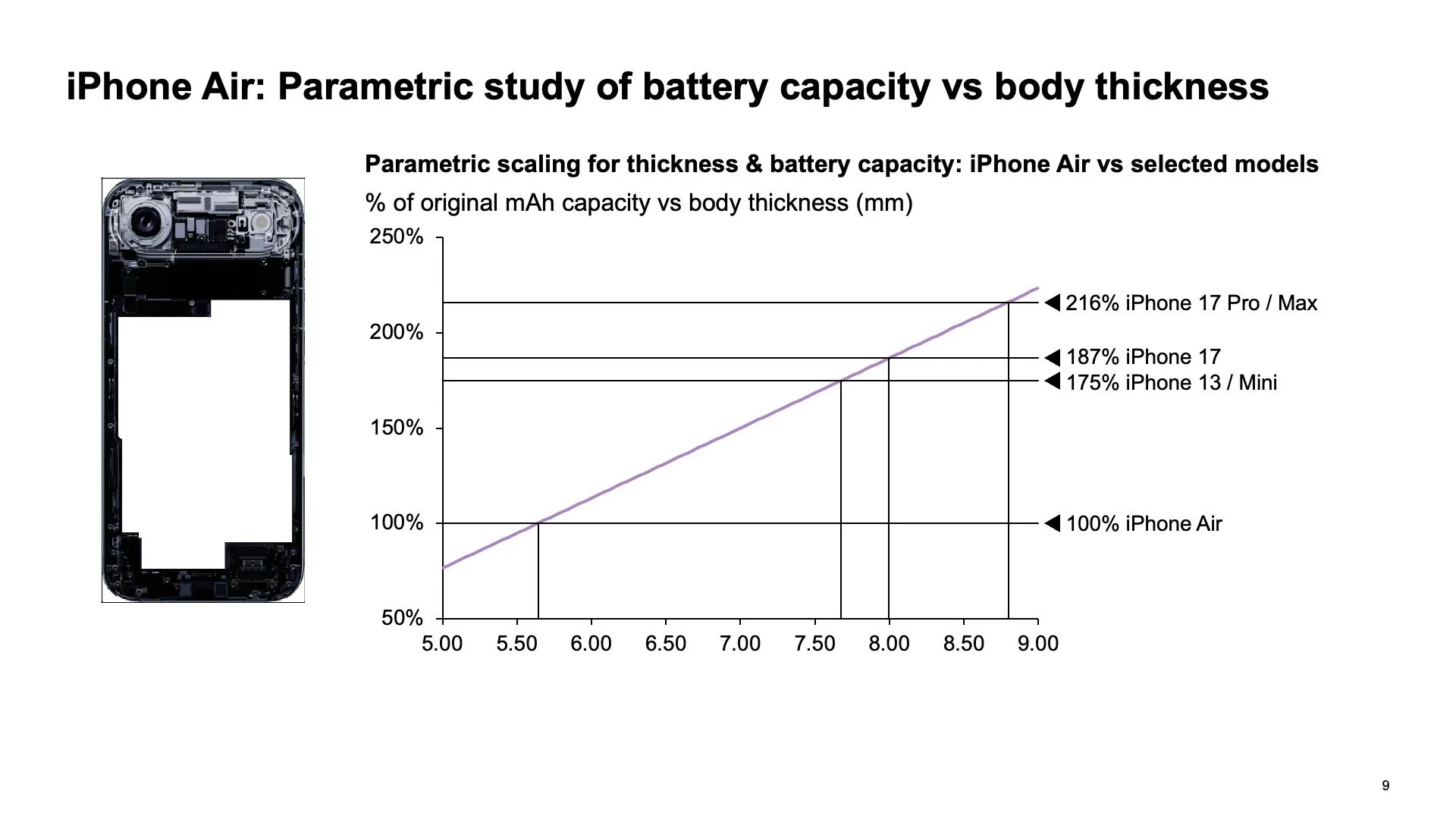

Thinness obviously has tradeoffs, and it is necessary to understand the primary tradeoff in terms of a variable that drives it: battery capacity as a function of body thickness. To do this, the iPhone Air’s relative battery capacity as a function of battery volume was modeled to determine how it would change with thickness. This is a form of parametric modeling, where a function of a parametric (body thickness) is created to approximate another parameter (battery capacity). This parametric model incorporated known factors: overall thickness (5.64 mm), battery thickness sourced from teardowns (2.7 mm), and battery shape. Once modeled as an equation, we can use the model with an input of body thickness to return a relative capacity, where 100% represents the current iPhone Air.

This chart shows how the battery capacity of an iPhone Air would vary with body thickness. Apple would have built similar models prior to detailed design to determine the overall thickness. This allows you to set major specifications without detailed design if the major constraints are known.

From the results of the model, it’s clear that Apple optimized heavily for thinness over battery capacity, with their preferred “all day” battery life standard allowing for a very thin, 5.64 mm device. What the study also tells is that scaling up about 2mm to 7.7 mm, the thickness of an iPhone 13 mini would have increased battery capacity by about 75% in the current iPhone Air with few other tradeoffs, equivalent to 5,510 mAh or 8% larger than the 5,080 mAh battery in the top-of-the-line iPhone 17 Pro Max.

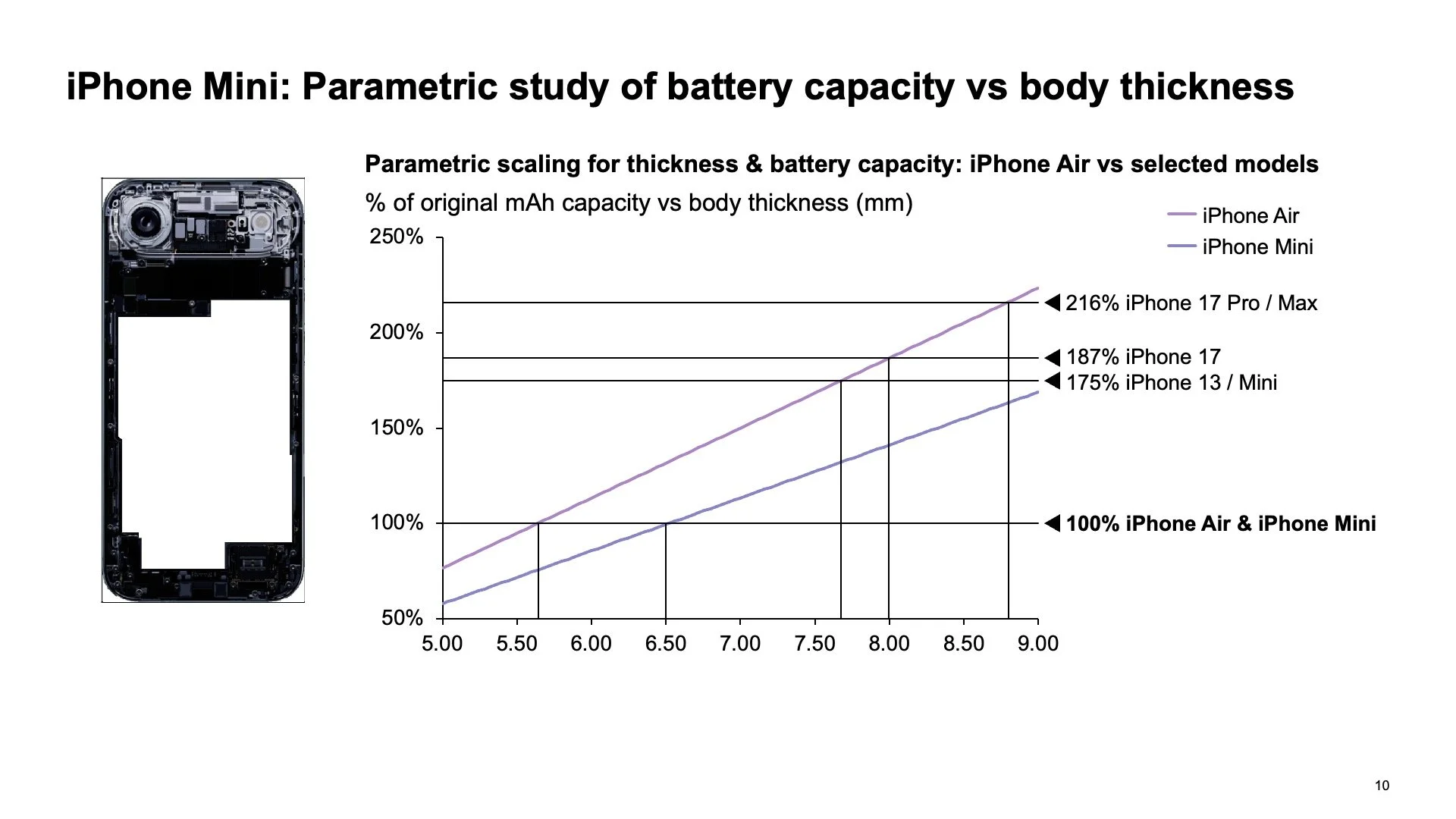

To fully scale to an equivalent iPhone mini form factor, the width and height of the battery can be directly reduced at the widest and tallest parts to create an iPhone mini equivalent battery. This allows us to perform the same parametric analysis to arrive at equivalent dimensions and capacities. At 6.5 mm thick, the model shows that you reach equivalent battery capacity to the full-sized iPhone Air, but in the smaller iPhone mini form factor. At this size and thickness including a 5.4” screen and 6.5 mm thick body, a notional iPhone Air mini would have same battery capacity and likely longer battery life compared to the 6.5” screen iPhone Air it is derived from.

This chart is similar to the last, with the addition of a second, lower curve that has been scaled for the width and height of a smaller device similar to an iPhone 13 mini. At 6.5 mm, the smaller device would have the same battery capacity as the much larger iPhone Air, assuming that packaging of internal components remained flexible.

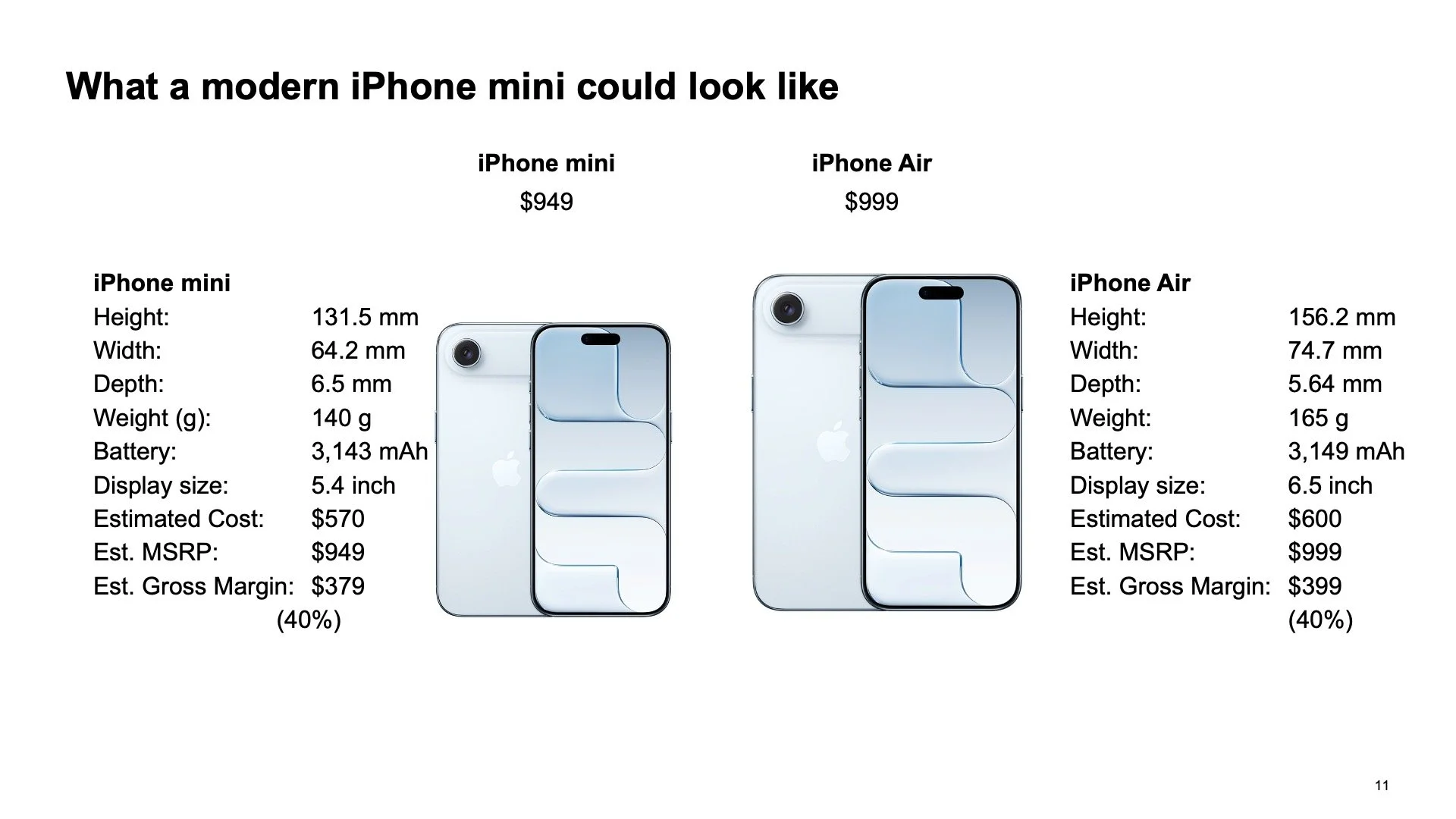

Now that we understand the major technical elements of the modeled iPhone Air mini, we can incorporate the learnings from the cost model and price laddering exercise to solve for the finished, simulated products. Priced at $949 (a 5% discount off the $999 iPhone Air), a 6.5 mm thick, 5.4 inch display iPhone mini would drive margins in-line with its larger sibling such that a runaway success would maintain product margins overall. That’s all a product manager could ever hope for!

The iPhone mini, positioned as a premium luxury device would occupy a new spot in the iPhone lineup

Priced at $949, an iPhone mini would fit cleanly into the current price laddering scheme. Enthusiasm is high. Demand is unknown.

What’s next

Apple maintains strict secretive about future products. Many have speculated that the mini phone is permanently dead; I disagree. I simply believe it was priced incorrectly, with margins that didn’t capture the premium that a luxury, small device can command in the lineup. We will leave it to Apple to forecast the demand and determine if there is a spot in future lineups for a device like this.

This is simply a desktop exercise using public information and opinion to show how targeting a product in a lineup is important to the success of that product. Use of Apple’s trademarks is

For those who want to hold onto their iPhone 12 or 13 mini and wonder how long it will be viable, I discovered a compelling proxy in my research: the original iPhone SE, the smallest iPhone of the last 11 years, just received an iOS 15 security update 9 years, 5 months and 15 days after release. I can only hope that my iPhone 13 mini holds out that long. Even better would be a small, new phone released sooner than that.