End of the IRA EV subsidy in the US: Deliveries and Pricing insights for 4Q 2025

By: Kevin Horn

Originally Published: October 7th 2025

The US Electric Vehicle market has seen significant changes in demand over the last 5 years. One of the most significant forces on the market has been the creation, and recent elimination of the Inflation Reduction Act credit for qualifying, new Electric Vehicles in the US. The credit, subject to MSRP and domestic sourcing requirements, applied to many new EV purchases in the US starting January 1st, 2023, ended on September 30th, 2025. provided tax credits of up to $7,500 per qualifying vehicle for new purchases or leases.

US and Global EV manufacturers have started to respond to shifting demand and elimination of the subsidy with varying strategies for pricing and incentives as well as wide ranging manufacturing and delivery forecasts. While the impacts of the repeal on the US EV market will not be fully known for a year or more, we can analyze early signals from the market leaders to understand more about their respective strategies.

Tesla

Tesla has managed expectations in 2025 for flat to declining overall sales without issuing full year guidance. The company has been impacted by several factors including wavering customer sentiment and a mature product lineup. Due to its overwhelming top position in the US market by volume, Tesla also is likely to have the highest magnitude of financial and sales exposure due to termination of the IRA subsidy. For the remainder of 2025, we’d expect a decline in quarterly output as compared to Q3 and on par with relative production totals for 2024: down 8% year over year, Q4 is 28% of annual deliveries in 2024 & 2025 (estimated). Note, since Tesla has not issued Delivery Guidance, the midpoint of analyst estimates for 2025 deliveries have been assumed for full year 2025 (1.65M deliveries).

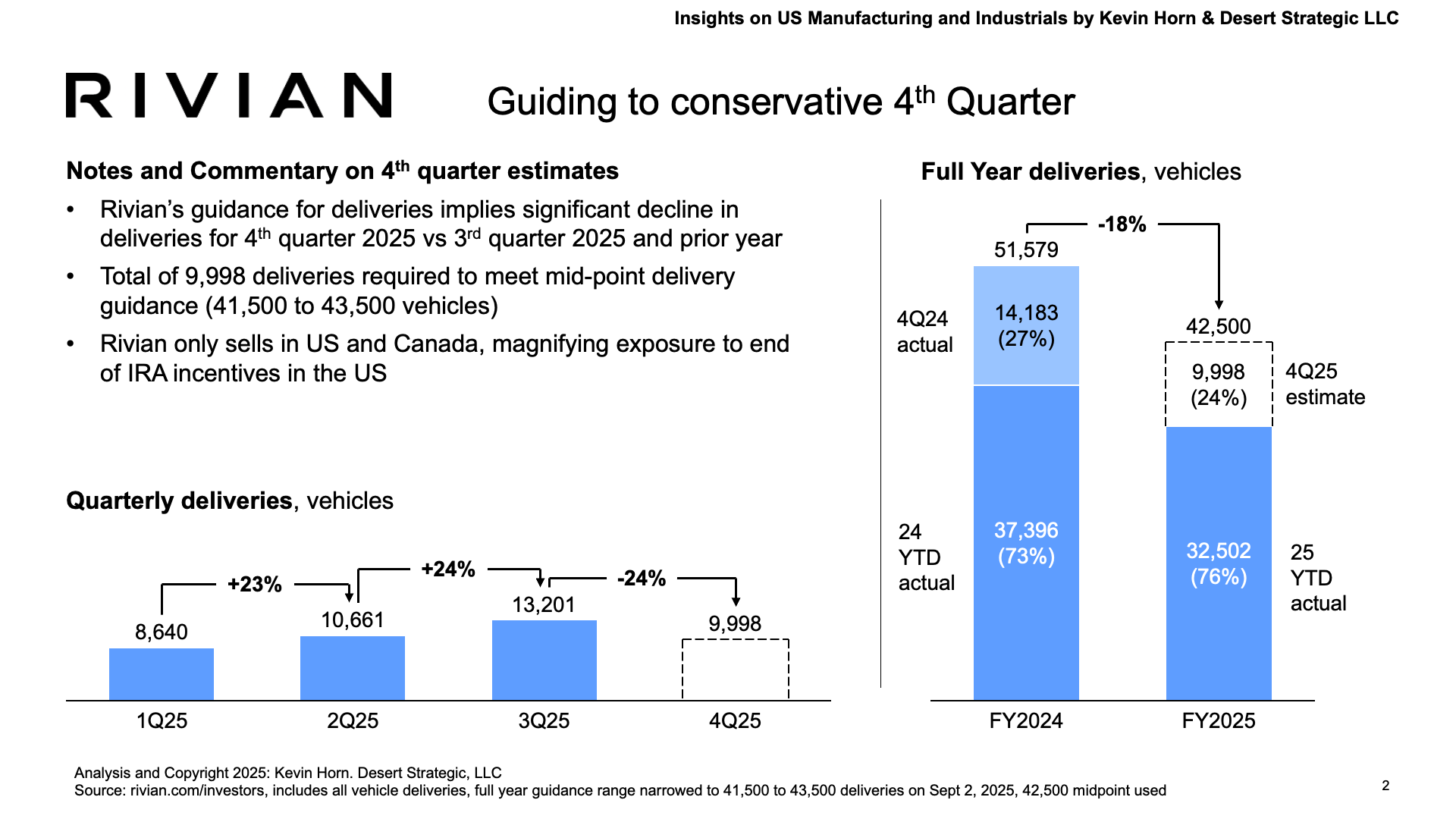

Rivian

At a significantly smaller scale than Tesla, Rivian has been more cautious in its delivery forecasts. They recently reaffirmed and narrowed their 2025 full year estimates on October 2nd, 2025 when they announced 3rd quarter production and delivery totals. Distinctly different from Tesla, however, is that many of Rivian’s vehicles would also have had limited or no eligibility for IRA subsidies due to MSRPs above $80,000 cap and historically not meeting domestic sourcing requirements. While this will may limit the impact of losing subsidies, Rivian still forecasts significantly reduced 4th quarter and full-year deliveries, down 24% from 3rd quarter and 18% year-over-year.

Lucid

Lucid Motors stands out with a significantly increased 4thquarter trajectory, based on revised production guidance issued at the 2ndquarter earnings call. While Lucid has maintained consistent growth in production and deliveries, meeting the low end of guidance (18,000 units) would require an 84% quarter-over-quarter increase in deliveries and represents a 99% increase year-over-year, since 2024.

Price cuts and incentives

To address the loss of IRA subsidies and corresponding pricing pressure on US buyers, Tesla introduced new trims on the Model 3 and Model 3 lines, shortly after the end of the IRA subsidies (October 7th 2025). These lower-cost “standard” trims reduce price point by $5,500 and $5,000 for Model 3 and Model Y, respectively, while attempting to retain price premium of existing trim, renamed “Premium” Long Range, AWD and Performance trims.

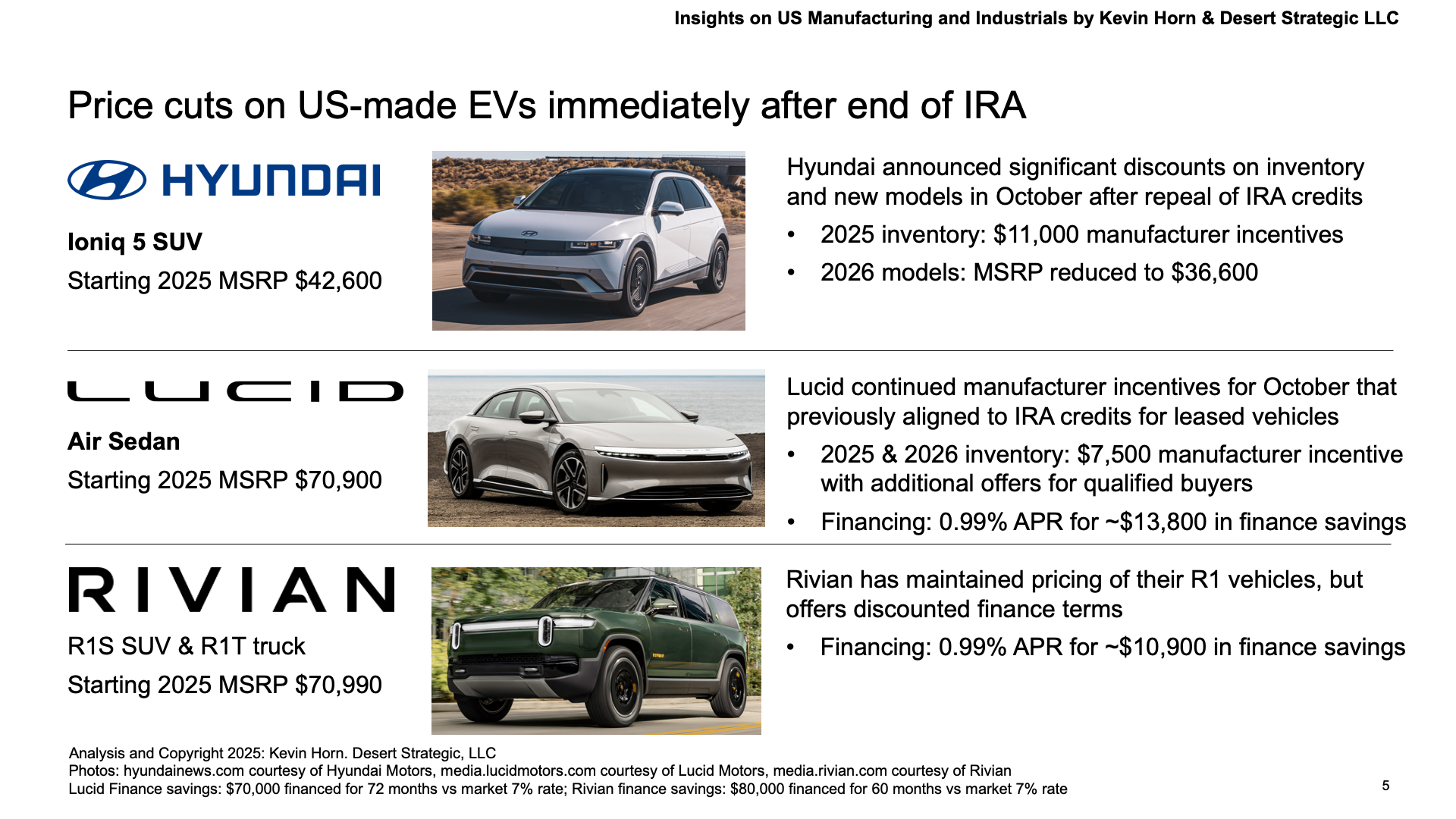

Beyond Tesla, aggressive price cuts and incentives continue to be announced of the time of this article. Notably, Hyundai announced a $7,500 price cut for their top-selling Ioniq 5 SUV for 2026 with separate manufacturer incentive of $11,000 on existing, unsold 2025 inventory. For premium manufacturers Lucid and Rivian, both are offering aggressive financing incentives for new buyers that could reduce financing cost by more than $10,000 over the life of the loan, as compared to market rates.

In conclusion

While it has only been days since the end of the Inflation Reduction Act incentives for new EVs in the US, the market is starting to adjust with pricing and production moves by manufacturers. Customer and market reaction remains to be seen, but initial price reductions are a sign that the removal of incentives will create downward pressure on both price and volumes in the near term for all EV manufacturers in the market.